Introduction

You’ve no doubt been taught to buy property with a high land component. The argument being, land appreciates while buildings depreciate. Nothing wrong with that concept, but then what should you end up buying?

- Houses instead of units?

- Houses on bigger blocks?

- Land?

Most investors assume this to mean, you should buy houses instead of units. Some investors aim for houses on bigger blocks. Some industry professionals recommend buying a property with an above average block size or floor size, regardless of whether it’s a unit or a house.

I’ve even read one blog, where the apparent expert claimed to have discovered the ideal ratio of land size to house size. And guess what, they just happened to be selling some stock that matched this precise ratio. What are the chances!

“Beware marketing disguised as education”

There’s a lot of nonsense that gets broadcast about. Hopefully this presentation will set the wrongs right.

Blocks of land

Let’s start with raw land – no building on it, bare dirt. Do you think a raw block of land would have a high land component? What about a great big slab of desert? Massive square metres, square kilo-metres even.

I can’t think of a time in the last 100 hundred years where Australian desert prices outperformed city prices. Obviously therefore, the largest number of square metres is not the answer, or the desert wouldn’t be near worthless.

OK, so what about land in a major city like Sydney? There are a few problems with buying raw land from an investment perspective:

- FINANCE

- RENT

- TAX

- Firstly, it’s hard to get finance to buy land unless you plan to build on it. So, leveraging more from a good investment is often not possible

- Secondly, without a property on it to rent out, it’s hard to earn any significant income from it. So, land usually has a very low yield if any income at all.

- And that leads to the 3rdpoint, if an asset doesn’t generate income, you can’t claim expenses related to that investment as a tax deduction.

So, in general, raw land has some issues which might not make it the best investment.

What’s important?

So, what should investors really be looking for? Well, it’s not the number of square metres you buy. And it’s not the block size versus the floor size. It’s actually got nothing to do with square metres at all. It’s to do with dollars.

“What are your dollars allocated to, land or liability?”

What you’re really after is the highest possible land to asset ratio or LAR for short.

Properties with a significantly higher land VALUE compared to the total asset’s VALUE will outperform similar properties in the same suburb – even in the same street.

Valuations

Let me just back up a bit. If you’ve ever seen a professional valuation report from a qualified valuer, you might have noticed that the value of a property is often broken up into land value and “improvements”. “Improvements” is the word they use for buildings that have been plonked on the land, improving the overall value of the address.

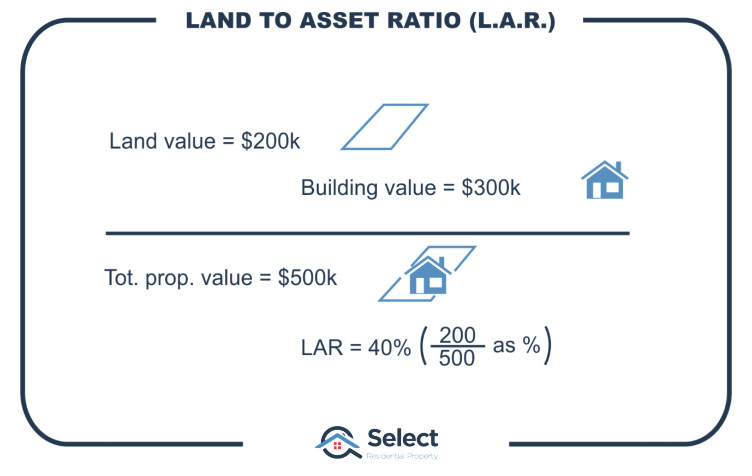

So, for example you might have a property valued at $500,000.

The land might be valued at $200,000 and the improvements valued at $300,000.

The Land Asset Ratio in this example would be 40% since $200,000 is 40% of the total asset’s value of $500,000. This is an extremely low LAR.

The valuer will estimate the cost of the building based on its current condition, size and age. If it was constructed recently, you’d expect the building to be valued higher. Similarly, if it’s a big house, it will be worth more. If it’s an old or small building, in poor condition, it might be valued lower.

Why do we look at it this way?

Why do we look at it this way? Well, remember how land appreciates and buildings depreciate. We want the highest proportion of our asset appreciating and the least amount depreciating. We want as much of our money going towards acquiring an asset and as little as possible going towards paying for a liability.

“An asset appreciates, e.g. land. A liability depreciates, e.g. a building.”

An example

It will all make better sense with a concrete example. Imagine property A is like the one I described: it’s worth $500,000 and has $200,000 worth of land so it has a 40% LAR.

- Property A

- Year 0: $500k

- $200k land

- $300k building

- LAR = 40%

- Year 0: $500k

- Property B

- Year 0: $500k

- $300k land

- $200k building

- LAR = 60%

- Year 0: $500k

Now imagine property B is also worth $500,000 but the breakdown of land value to building value is different. In the case of property B, the land is worth $300,000. This means the LAR is 60%.

Two properties of the same total value, but property B has a higher Land Asset Ratio than property A. How is this possible? Well, property B might have a smaller house on it, or it might be older. Or it might have a bigger block or the block might be in a better location.

What happens?

Let’s see what happens to the values of these two properties over time.

- Land appreciation = 10% pa

- Building depreciation = 2% pa

Imagine that land appreciates for both properties at the exact same rate – 10% per annum. And let’s assume the buildings depreciate at the same rate too – at 2% per annum.

- Property A

- Year 0: $500k

- $200k land

- $300k building

- LAR = 40%

- Year 1: $514k

- $220k land

- $294k building

- Total growth = 2.8% ($14k)

- New LAR = 42%

- Year 0: $500k

- Property B

- Year 0: $500k

- $300k land

- $200k building

- Year 1: $526k

- $330k land

- $196k building

- Total growth = 5.2% ($26k)

- New LAR = 63%

- Year 0: $500k

After the first year, property A’s land has grown by 10% from $200,000 to $220,000. The $300,000 building however, has depreciated by 2% from $300,000 to $294,000. So, the combined value of house and land a year later gives property A the new value of $514,000.

Over the same timeframe, property B’s land also appreciated by 10%. It went from $300,000 to $330,000. And the building depreciated at the same rate of 2% to go from $200,000 to $196,000. The combined land and building value for property B is now $526,000.

Comparing A with B

Property A has grown by 2.8% while property B has grown by 5.2%. Both started at the same value, both had the same land appreciation rate and the same building depreciation rate. The reason property B’s growth almost doubled property A’s growth is because B had a higher LAR than A.

The difference in just one year is $12,000. By simply choosing high LAR properties over low LAR properties, investors can be better off by staggering amounts.

Note how the LARs have changed now. The value of the land has gone up and the value of the building has gone down. So the LAR has improved in both cases. And the longer you own a property, the higher the LAR will get.

It makes sense therefore that newer properties typically have lower LARs. This is because much of the expense related to the property is in the building of it. Developers want to buy the cheapest land and add the most value to maximise profits. But this strategy minimises profits for investors who buy from developers.

Most new house and land packages are usually in suburbs with low land value on tiny blocks. Land asset ratio is one of the biggest arguments against investing in new house and land packages. And you can see from these very simple calculations why.

It’s testament to the tremendous marketing skills of developers that most investors aren’t even aware of this despite how simple the concept is.

Typical high LAR properties

Oddly, some units actually have high LARs. Remember, it’s not the square metres that count, but the value of that tiny bit of land under the building compared to the overall value of the asset. That’s what matters.

But most units won’t have a very high LAR. The ones that do are in small boutique blocks in prestigious areas and they’re usually very old.

Imagine a high-rise apartment complex built on a block of land worth $20m and there are 200 units in the complex. Each unit therefore has a land value of $100,000. If the unit cost an investor $500,000 to buy, then the LAR is 20%. That’s appalling. And the growth is usually appalling too.

Contrast that with a group of 12 units in a 3-storey walk-up boutique complex. If the land was bought for $2.4m, then each unit has land value of $200,000. If they’re priced at $500,000 they’d have an LAR of 40%. Although that’s still very low, it’s twice as good as an LAR of only 20%.

Interestingly, the houses with the highest LARs are also old. It makes sense if you think about it…

Older dwellings have already depreciated and lost much of their value. All that time they were depreciating, the land was appreciating. So, over time the LAR gets higher and higher.

Penny dropping

Right now, the penny is dropping amongst some of you about that age-old debate: new vs old. If it still hasn’t dropped, check out my presentation on why you shouldn’t buy new properties…

There’s a similar one on why you shouldn’t chase after properties with high depreciation benefits.

Avoid properties with high depreciation

Conclusion

The LAR is a pretty straightforward concept isn’t it. A little hard to argue against when the maths is so easy, right?

So, how come it’s such a poorly understood concept and not common knowledge among property investors? Well, remember what I said about nonsense being broadcast? Imagine you’re a property developer trying to flog off some stock to uneducated investors. Teaching them about the LAR isn’t going to help you sell anything new is it. And that’s when their B.S. starts.

If you’re interested in protecting yourself from more B.S., check out some of the other topics in this series, in particular that one about buying new and the one about depreciation “benefits” – no such thing!